december child tax credit amount

Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. For every 1000 the MAGI exceeds the limitations above the amount of tax credit allowed to be claimed is reduced by 50.

Child Tax Credit Payment Schedule For 2021 Kiplinger

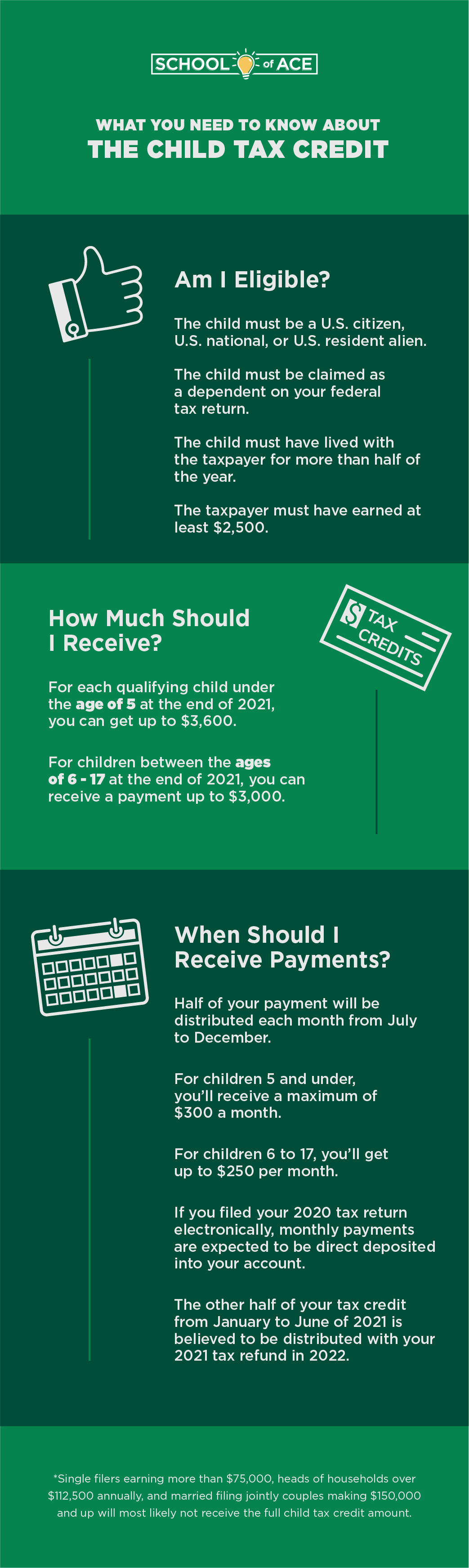

The full credit is available for heads of households earning up to.

. Ad Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide. Visit ChildTaxCreditgov for details. If that family received a total of 1800 in advance Child Tax Credit payments over the final six months of 2021 each spouse would receive their own Letter 6419.

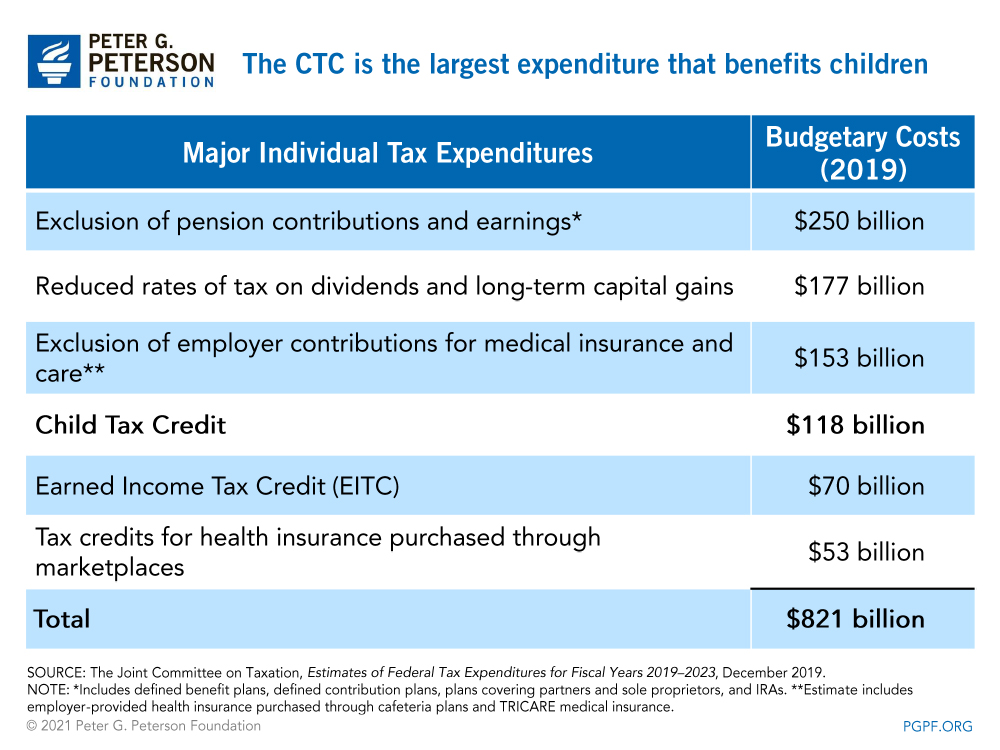

6 Often Overlooked Tax Breaks You Dont Want to Miss. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. Up to 1800 per child.

Specifically the Child Tax Credit was revised in the following ways for 2021. This means a payment of up to 1800 for each child under 6 and up to 1500. Those who qualify for the full payments are couples earning less than 150000 a year single parents who file as heads of households on less than 112500 and individuals on.

A single taxpayer with 2 qualifying children. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds.

Learn More at AARP. Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible increased from. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

The credit amount was increased for 2021. For each child aged six to 17 families. Check How to Qualify for the Child Tax Relief Program with Our Guide.

Why have monthly Child Tax Credit payments. Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes. An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit.

Ad Start and Complete Your Child Tax Credit Online Start Now. You wont get a payment in January but you can expect more enhanced child tax credit money to arrive this year. The amount on each letter.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The deadline to do so is 15 November so those who get their submissions in before Monday could receive a lump sum worth up to 1800 per child in December covering. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

For children under 6 the amount jumped to 3600. 150000 if married and filing a joint return or if filing as a qualifying. Families signing up now will normally receive half of their total Child Tax Credit on December 15.

Here is some important information to understand about this years Child Tax Credit. 100s of Top Rated Local Professionals Waiting to Help You Today. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

The next child tax credit check goes out Monday November 15. Families who will be claiming payments for the first time will be getting 1800 per child under age six this month. The American Rescue Plan increased the amount of the Child Tax.

The Child Tax Credit provides money to support American families.

Child Tax Credit Why The December Payment May Be Less King5 Com

Irs Will Send Out The Last Advance Child Tax Credit Payment By December 15 2022 Where S My Refund Tax News Information

How Much Money Will Families Have Received From Child Tax Credit By December 2021 As Usa

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

What You Need To Know About The Child Tax Credit

Final Check Child Tax Credit Payment For December Youtube

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit Dates Last Day For December Payments Marca

The 2021 Child Tax Credit John Hancock Investment Mgmt

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

What Is The Child Tax Credit Tax Policy Center

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Will You Have To Repay The Advanced Child Tax Credit Payments Wdtn Com

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News